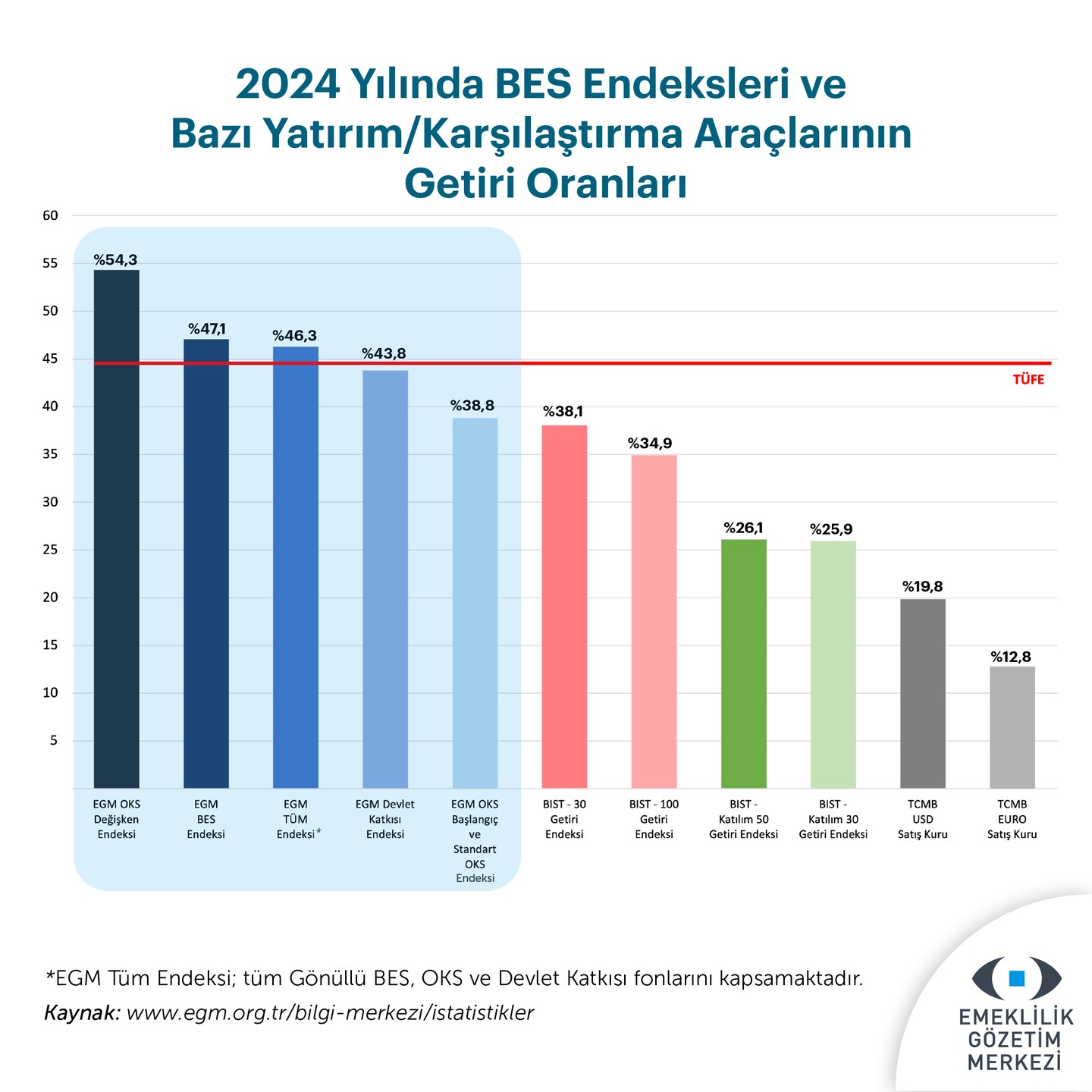

In 2024, the Turkish retirement savings landscape has shown robust growth, particularly in the context of the EGM (Pension Monitoring Center) BES (Voluntary Pension System) indices. The OKS Variable Index achieved a remarkable 54.3% change, while the BES Index and the Overall Index reported increases of 47.1% and 46.3%, respectively. Notably, these figures outstrip the annual inflation rate, measured at 44.4%, emphasizing the strong performance of these pension funds.

When compared to major stock indices such as BIST 30, BIST 100, Katılım 30, and Katılım 50, as well as USD and EURO exchange rates, the reported changes in BES indices are significantly higher. Among the 238 available Voluntary BES funds, 146 have surpassed the annual inflation rate in returns. Similarly, from a total of 112 OKS funds, 87 have yielded returns above the inflation threshold. These positive real return funds collectively represent 77% of the net asset value within the Voluntary BES and OKS fund markets.

This robust performance highlights the growing significance of private pension schemes in Turkey’s investment landscape, making them a viable option for future financial planning amidst inflationary pressures.