As of October 31, 2024, the distribution of voluntary pension savings (BES) reveals that 14% of the assets are allocated to low-risk funds (risk level: 1-2), 27% to medium-risk funds (risk level: 3-4), 28% to high-risk funds (risk level: 4-5), and a substantial 60% to very high-risk funds (risk level: 5-6-7). It is noteworthy that some pension funds fall into multiple risk categories, resulting in a cumulative percentage exceeding 100%.

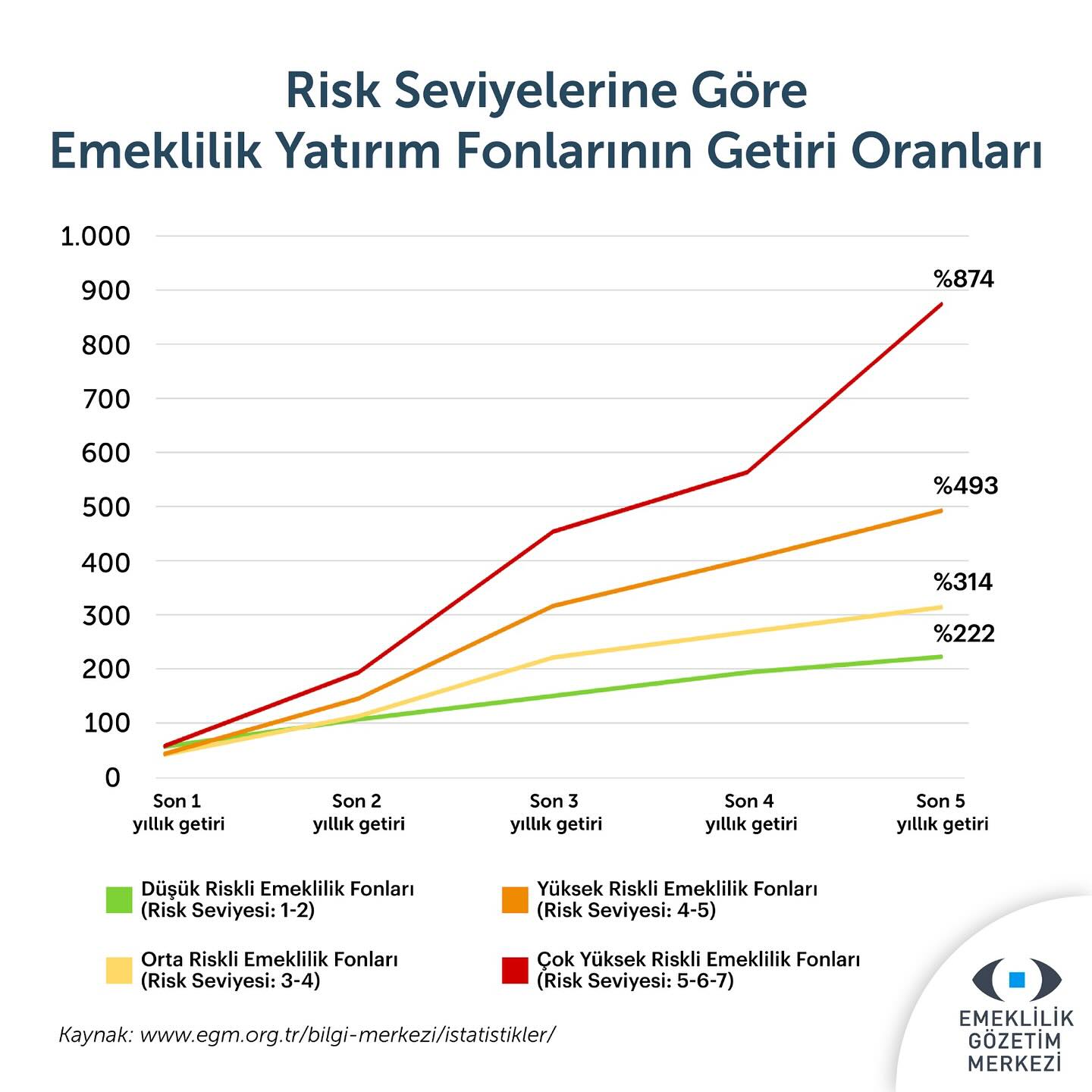

Regarding performance, low-risk funds have achieved a return of 57% over the past year, while medium-risk funds yielded a 42% return. High-risk funds produced a slightly lower return of 43%. Very high-risk funds matched the performance of low-risk funds, also reporting a 57% return.

This data reflects the diverse investment strategies within the individual pension sector, illustrating the potential for varied returns across different risk profiles.