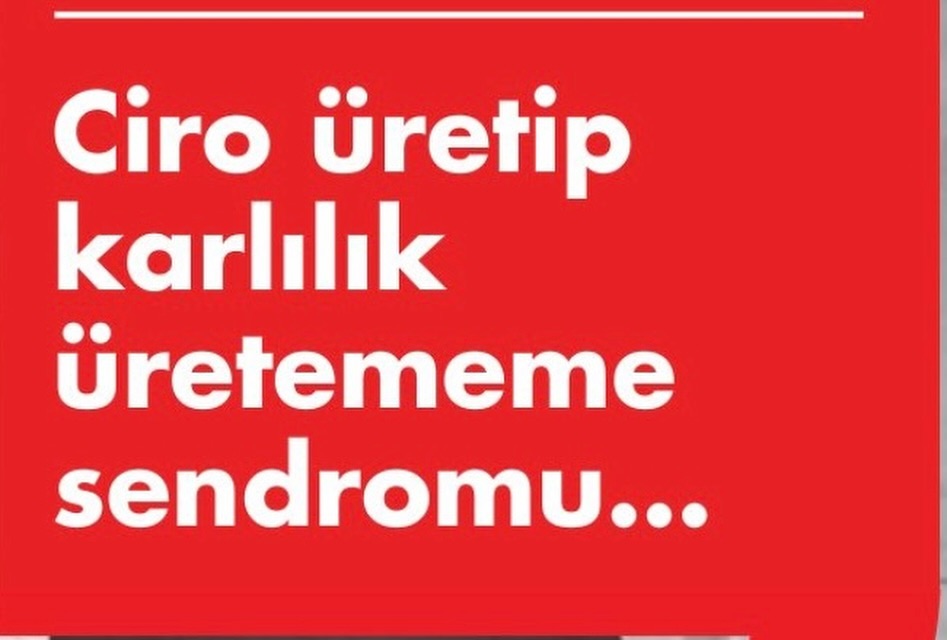

The Turkish insurance sector is currently facing significant challenges according to recent assessments highlighting key issues within the industry. A primary concern is the disparity between revenue generation and profitability, particularly in technical profits across various branches. The sector’s revenue predominantly originates from insurance agents, who are essential in maximizing production but are hindered by overarching economic factors, including national growth rates and inflation that inflate general expenses.

Despite the presence of revenue, there is a pressing need for substantial structural reforms, with legislative gaps identified particularly under the Insurance Law No. 5684. Industry stakeholders emphasize the urgent requirement for a comprehensive umbrella legislation, termed the “Framework Law,” to address these shortcomings effectively.

A coalition of regulators and industry associations, such as the Turkish Insurance Association (TSB), the Insurance Association of Turkey (SAİK), and the Association of Insurance Brokers (TÜSAF), is critically called upon to convene and take decisive actions to rectify these structural issues. Furthermore, the establishment of a dedicated union for insurance agents is deemed essential for enhancing operational coherence between the TSB and regulatory bodies like SEDDK.

The collective sentiment within the insurance agent community is one of urgency, as these longstanding issues are perceived as existential threats to their profession, marking two decades of unresolved challenges that require immediate attention to secure the future of the industry.