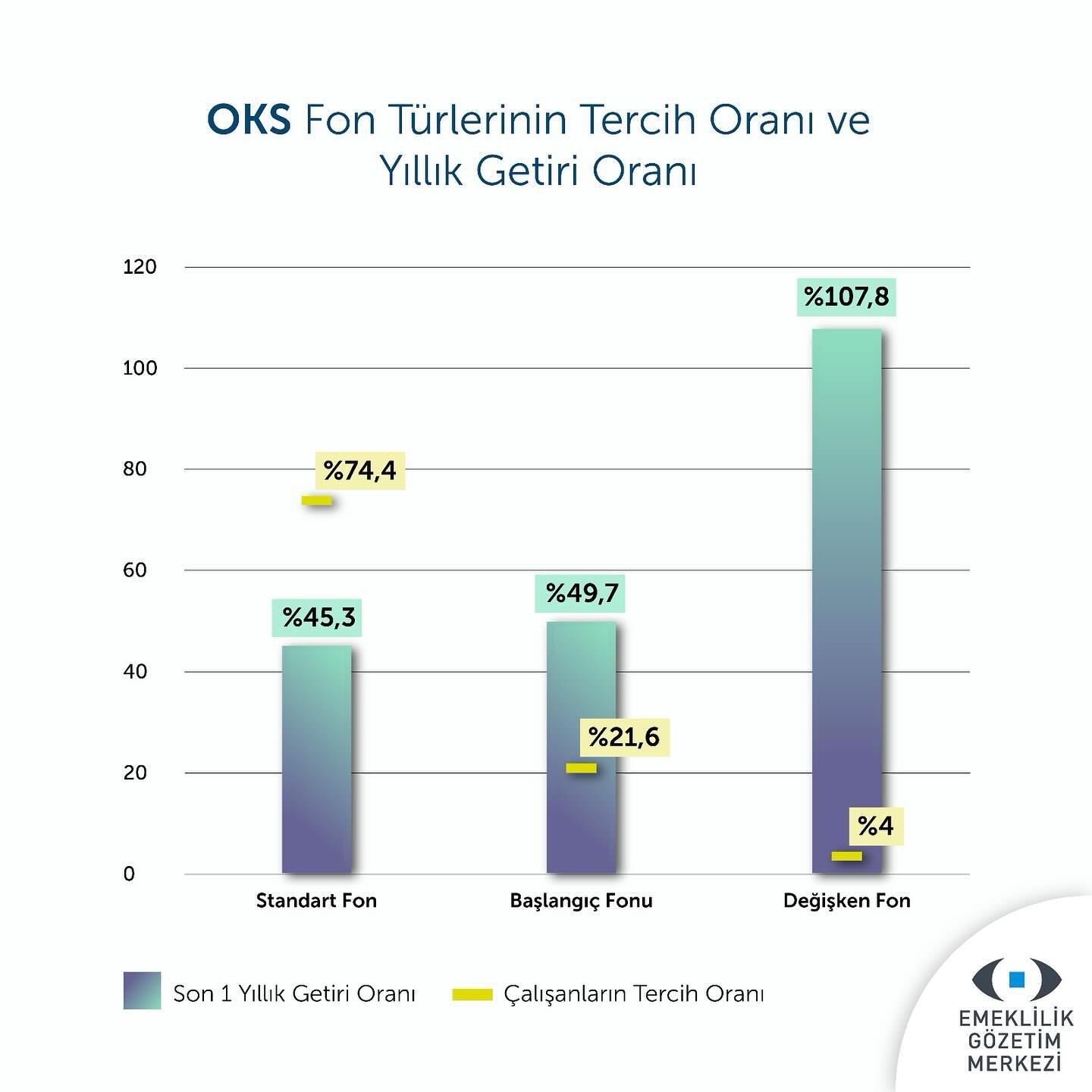

As of the end of June 2024, a significant 96% of participants in Turkey’s Automatic Enrollment System (OKS) have investment portfolios predominantly composed of OKS Starter or OKS Standard funds, while only a mere 4% have invested in OKS Variable funds.

Since its inception in 2017, returns from OKS Starter funds have remained below the inflation rate, except for the year 2019. Similarly, returns from OKS Standard funds have fallen below inflation in 2019 and 2022. In contrast, OKS Variable funds have outperformed inflation, with the exception of the years 2018-2021 and 2023.

In the period from June 2023 to June 2024, OKS Starter and OKS Standard funds reported returns of 45.3% and 49.7%, respectively; both figures lag behind the inflation rate of 71.6%. However, OKS Variable funds delivered significantly higher returns, achieving a peak return of 196% and an average annual return of 108%.

Participants who have yet to select a fund can enhance their return potential by adjusting their fund allocation through their pension company’s mobile application, website, or call center. Additionally, they can monitor their investments and chosen funds via the BES Mobile platform.